Provide Accurate Payroll, Localized Insurance and Benefits - Without a Local Entity

Watch a VideoGet started

Provide Accurate Payroll, Localized Insurance and Benefits - Without a Local Entity

Watch a VideoGet started

Trusted by businesses, big and small, across the globe

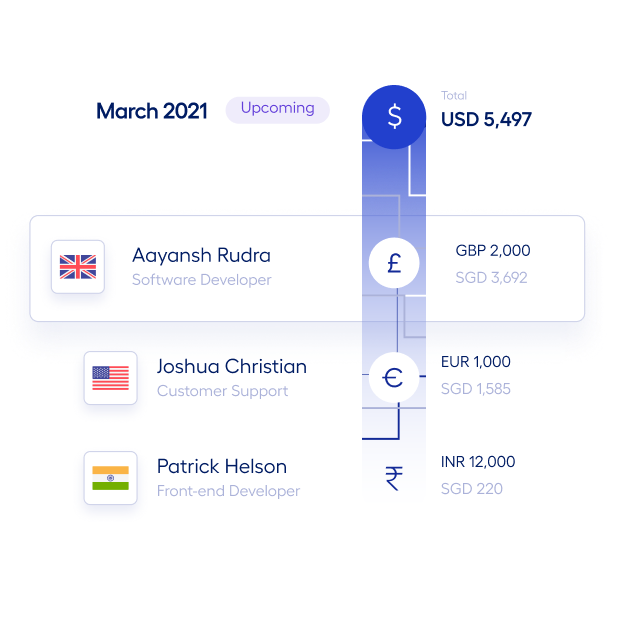

Run payroll for your global workforce

Ensure a quick and timely payroll process—save costs by removing the need for multiple providers across different countries

Provide locally competitive, best-in-class, homogenous benefits, and insurance

Add freelancers to the platform, allow them to raise invoices and expenses through Multiplier and clear them in their preferred currencies in a matter of minutes

Pay your freelancer invoices on the go

Add freelancers to the platform and allow them to raise invoices and expenses, through Multiplier. Clear them all in their preferred currencies in a matter of minutes.

Everything you need to run a

unified and accurate payroll

Zero-error multi-country payroll in a single click

A platform to manage reimbursements, view payslips, track expenses and offer benefits.

Zero-error multi-country payroll in a single click

A platform to manage reimbursements, view payslips, track expenses and offer benefits.

Zero-error multi-country payroll in a single click

A platform to manage reimbursements, view payslips, track expenses and offer benefits.

Zero-error multi-country payroll in a single click

A platform to manage reimbursements, view payslips, track expenses and offer benefits.

The Multiplier Experience

An all-encompassing platform for payroll, benefits, insurance and more.

Multi-lingual

contracts

One-click

payroll

Multi-currency

payments

Guaranteed

compliance

Multi-country

onboarding

Grow your business globally with our fixed priced guarantee.No hidden costs, ever

Check out our 100% transparent pricing

Global Brands love us for

Ease of use, customer support and great product

Frequently Asked Questions

WHAT IS AN UMBRELLA COMPANY?

As an umbrella company, The Simple Umbrella is a payroll provider for contractors. We act as your employer, process your wages, and offer additional support such as administration. It means you can work between different contracts and they handle your admin and payroll, so your activities are focused on finishing and finding more work.

WHAT ARE THE BENEFITS OF AN UMBRELLA COMPANY?

Once you’ve signed up you with us you will have an employment contract and benefit from all of the same employment rights as other permanent employees. You will be able to carry out multiple short-term contracts with less overall risk.

WHAT IS IR35?

R35 or as is more formerly known “Intermediaries Legislation” c was introduced by HMRC in 2000 as tax legislation specifically designed to battle tax avoidance by workers supplying services to clients through an intermediary, such as a limited company and used to assess whether a contractor is a genuine contractor rather than a ‘disguised’ employee, for the purposes of paying tax.

DO I FALL UNDER IR35?

There are many intricacies to determinign wheter you fall under IR35, and you should contact us so we can analyse your situation specifically However, there are a few principles to consider to check if you fall under IR35. For example, you should see whether the contract specifically mentions these principles:

WILL I STILL NEED INSURANCE?

As your employer, we ensure that you are covered by all our insurances. We provide employees with Professional Indemnity, Employers’ Liability and Public Liability Insurance as a standard.

Ready to take the leap?

Choose Multiplier as your EOR partner